X Financial Technologies

Tech and user flows.

| Flow | Steps |

|---|---|

| Token Creation (Price > NAV) |

1. AP identifies arbitrage opportunity 2. AP calculates required assets/cash based on current NAV 3. AP transfers assets/cash to issuer 4. Issuer verifies received assets/cash 5. Issuer mints corresponding number of tokens 6. Issuer transfers tokens to AP's wallet 7. AP lists tokens for sale on the market 8. AP executes sales to capture arbitrage profit |

| Token Redemption (Price < NAV) |

1. AP identifies arbitrage opportunity 2. AP purchases tokens from the market 3. AP initiates redemption request with issuer 4. Issuer verifies token ownership and validity 5. Issuer calculates NAV for redemption 6. Issuer burns redeemed tokens 7. Issuer transfers corresponding assets/cash to AP 8. AP receives assets/cash, realizing arbitrage profit |

| Asset Transfer | 1. Transferring party initiates transfer request 2. System verifies transferring party's balance/ownership 3. System calculates transfer amount based on current NAV 4. Transferring party confirms transfer 5. System executes transfer 6. Receiving party confirms receipt 7. System updates balances and records |

| Token Minting | 1. System detects conditions for minting (NAV increase or share conversion) 2. Calculate number of tokens to mint 3. Verify backing assets are available 4. Execute minting process 5. Assign newly minted tokens to appropriate wallets 6. Update total supply records 7. Notify relevant parties of minting event |

| Token Burning | 1. Redemption request triggers burn process 2. System verifies tokens to be burned 3. Calculate impact on total supply and NAV 4. Execute token burn 5. Update total supply records 6. Adjust backing assets accordingly 7. Notify relevant parties of burn event |

| Dividend Distribution | 1. System detects eligibility for dividend distribution. 2. Calculate dividend amount based on NAV and token holdings. 3. Verify available assets/cash for distribution. 4. Execute dividend payout process. 5. Transfer dividends to token holders' wallets. 6. Update records for token holder distributions. 7. Notify relevant parties of dividend event. |

| Distribution Swap | 1. Fund Manager deposits USD for distribution 2. XFT converts USD to USDC 3. USDC is transferred to the Fund Account 4. Distribution Smart Contract distributes USDC to token holders based on shares 5. Distribution is logged and confirmed |

| User Registration | 1. User submits registration request with required information 2. System performs KYC/AML checks 3. Create user profile in system 4. Generate wallet address for user 5. Associate wallet address with user profile 6. Return user ID and wallet address to user 7. Provide user with access to trading platform |

| Buy Order | 1. Client sends buy order request via API 2. XFT processes: creates order, locks client funds 3. XFT sends order creation confirmation to client 4. XFT lists order in order book 5. When match found, XFT executes part or all of the order 6. XFT updates token balances and cash balances 7. XFT sends execution and balance update notifications to client 8. If partially filled, steps 5-7 repeat until order is fully executed or cancelled 9. XFT sends final order filled notification to client |

| Sell Order | 1. Client sends sell order request via API 2. XFT processes: creates order, locks client tokens 3. XFT sends order creation confirmation to client 4. XFT lists order in order book 5. When match found, XFT executes part or all of the order 6. XFT updates token balances and cash balances 7. XFT sends execution and balance update notifications to client 8. If partially filled, steps 5-7 repeat until order is fully executed or cancelled 9. XFT sends final order filled notification to client |

| NAV Oracle | 1. Gather current market values of all fund assets 2. Calculate total liabilities 3. Subtract liabilities from assets 4. Divide by total number of tokens 5. Update NAV in the system 6. Trigger any necessary actions based on NAV change (token minting/burning) |

| NAV Token | 1. Fund sources send real-time data feeds 2. Blockchain platform collects, validates, and stores data 3. NAV engine accesses data from the blockchain 4. Calculate total liabilities 5. Compute NAV 6. Record NAV on the blockchain 7. Smart contract monitors NAV on the blockchain 8. Smart contract updates token value 9. Trigger necessary actions based on NAV change (token minting/burning) 10. Broadcast updated token value to market participants |

ETF NAV Fixing

| Flow | Steps |

|---|---|

| NAV-based order process and creation of ETF shares | 1. Investor places NAV-based order with AP 2. AP buys basket in the market 3. AP transfers basket to ETF for in-kind creation 4. ETF performs NAV fixing 5. AP provides cash to ETF for cash creation 6. ETF performs NAV fixing 7. ETF issues shares at NAV to AP 8. AP forwards ETF shares at NAV to Investor |

ETF Units

Overview of traditional ETF arbitrage.

| Scenario | Action | Steps | Arbitrage |

|---|---|---|---|

| Price > NAV | Create | 1. AP gives assets/cash to issuer 2. Issuer creates ETF shares for AP 3. AP sells shares in market |

Premium |

| Price < NAV | Redeem | 1. AP buys ETF shares from market 2. AP gives shares to issuer 3. Issuer returns assets/cash to AP |

Discount |

CEF Tokens

Arbitrage between NAV tokens and closed-end fund shares .

| Scenario | Action | Steps | Arbitrage |

|---|---|---|---|

| Price > NAV | Create | 1. AP gives assets/cash to issuer 2. Issuer mints tokens for AP 3. AP sells shares in market |

Premium |

| Price < NAV | Redeem | 1. AP gives assets/cash to issuer 2. Issuer mints tokens for AP 3. Issuer redeems tokens for underlying assets/cashP |

Discount |

Tokenization Events

| Corporate Action | Type | Definition |

|---|---|---|

| Dividend Decrease | Speculative | Reduction in dividend payout; can widen discount to NAV. |

| Leverage Amount Change | Speculative | Adjustment in leverage; can lead to market uncertainty and mispricing. |

| Liquidation/Dissolution | Share purchase | Sale of assets below value; opportunity to capitalize on liquidation. |

| Merger | Share purchase | Combining of funds; may cause price discrepancies, potential for arbitrage. |

| Rights Offering | Share purchase | Shareholders can buy additional shares at a discount to maintain ownership; NAV arbitrage. |

| Secondary Offering | Share purchase | Issuance of additional shares; can dilute value and lead to NAV discount. |

| Tender Offer | Share purchase | Company offers to buy back shares at a premium; opportunity to capitalize. |

| Delisting Common Shares | Share purchase | Shares are removed from exchange; potential mispricing due to market exit. |

| Significant NAV Changes | Speculative | Large changes in NAV; market may lag in reflecting new NAV, leading to pricing errors. |

| Discount to NAV Widens | Speculative | Share price drops further below NAV; buying opportunity with potential for NAV alignment. |

Premium

| Token Creation (price > NAV) | |||||

|---|---|---|---|---|---|

| 1. AP identifies arbitrage opportunity | |||||

| 2. AP calculates required assets/cash based on current NAV | |||||

| 3. AP transfers assets/cash to issuer | |||||

| 4. Issuer verifies received assets/cash | |||||

| 5. Issuer mints corresponding number of tokens | |||||

| 6. Issuer transfers tokens to AP's wallet | |||||

| 7. AP lists tokens for sale on the market | |||||

| 8. AP executes sales to capture arbitrage profit |

Discount

| Token Redemption (price < NAV) | |||||

|---|---|---|---|---|---|

| 1. AP identifies arbitrage opportunity | |||||

| 2. AP purchases tokens from the market | |||||

| 3. AP initiates redemption request with issuer | |||||

| 4. Issuer verifies token ownership and validity | |||||

| 5. Issuer calculates NAV for redemption | |||||

| 6. Issuer burns redeemed tokens | |||||

| 7. Issuer transfers corresponding assets/cash to AP | |||||

| 8. AP receives assets/cash, realizing arbitrage profit |

Money Market Funding Engine

| 1. Investors deposit cash with the MMF’s custodian. | |||||

| 2. The MMF selects and invests in money market securities according to the Investment Policy of the Fund. | |||||

| 3. Purchased securities are held at the MMF’s custodian on behalf of the Investors. | |||||

| 4. Returns on the portfolio may either be paid to investors periodically or reinvested in the fund. |

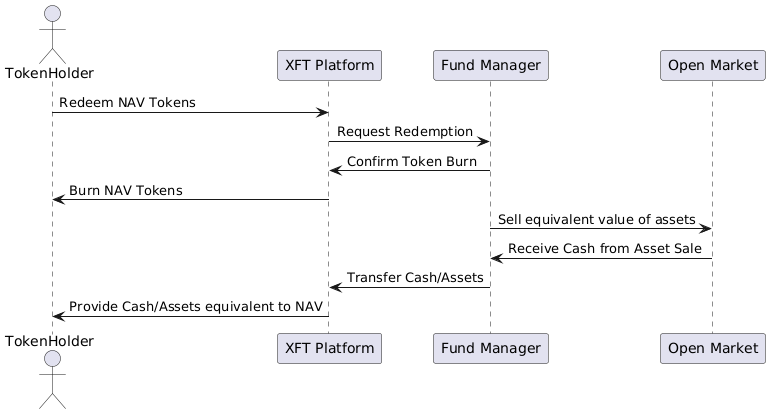

NAV token redemption

Result: Token holder receives cash/tokenized assets equal to the NAV of the redeemed tokens, and the fund's NAV decreases accordingly.

- Market Price < NAV: Buy shares, convert to tokens at NAV, sell tokens or redeem for NAV.

- Market Price > NAV: Mint tokens at NAV, buy shares at NAV, sell shares at a premium, or sell tokens at a higher market price.